Travel Logs - Vehicle Logbook

Travel Logs is an extremely easy and effective way to track your trips for all of your vehicles. With a streamlined information-entry user interface and, the added option of using GPS to auto-fill in location information - you dont need the paper version any more! Also track vehicle maintenance/service records and expenses.

Logging information for a trip has never been so easy thanks to the GPS auto-fill feature that will automatically fill in your location, with a press of a button, and calculates the distance traveled using the GPS of your device.

KEY FEATURES

- ATO Compliant.

- Cloud sync (iCloud, Dropbox).

- Local Sync.

- Bluetooth hands-free support for auto start/stop.

- Location aware for auto start/stop.

- NFC tag support.

- Multiple Vehicles.

- Contacts integration.

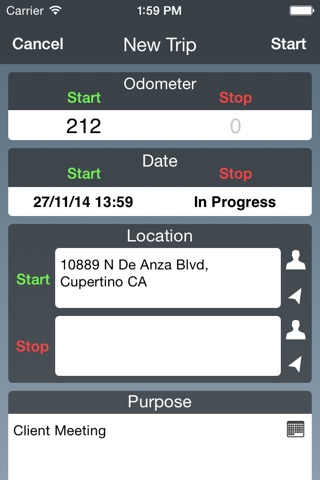

- Log trip details (odometer, date, purpose, type, location, vehicle).

- Exporting of log reports in CSV & PDF format.

- Location auto-fill and distance calculation.

- Import calendar entries to use as trip purpose.

- Route recording and exporting (GPX file).

- Vehicle expense tracking.

- Vehicle maintenance/service logs.

Sync Support

Sync and store your data on cloud services such as iCloud or Dropbox. Alternatively, sync using 365 Direct Sync without using a cloud service. 365 Direct Sync will transmit directly to your other device over your local network.

GPS - Location Auto-fill and Tracking

Travel Logs has the option to allow you to use the GPS feature in your device to determine your current and/or end location. This will give you the option to auto-fill in the location details for your logs and also track the distance traveled so you wont have to fill in the end odometer values!

Note: Continued use of GPS running in the background can dramatically decrease battery life.

Places

Automatically start and end trips when your depart or arrive at specified locations.

Bluetooth Hands-Free Support

Automatically start and stop trips when connected to your vehicles hands-free device.

NFC Tags

Assign and use NFC tags to automatically start and stop trips.

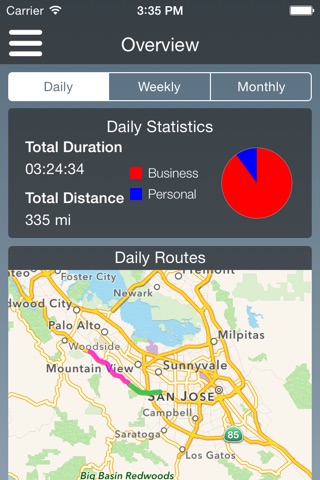

Route Recording

Realtime GPS tracking can record the route you took for that trip. Viewing past trips will be plot the route on the map so you can see where you went, down to each individual street.

Contacts & Calendar Integration

Select your addresses from your contacts from right within the application. Import calendar entries to use as your trip purpose.

Log Exporting

The log reports are in PDF and CSV format.

This app complies with the Australian Tax Office (ATO) logbook format. It will calculate the percentage of business use for each vehicle and total business distance in the exported log reports.

The log reports include total distance traveled, the starting and ending odometer values, date/time, purpose of trip, trip type, location from start to finish, driver name, vehicle and registration number.

Vehicle Expense Tracking

Track the expenses and credits for each of your vehicles.

Vehicle Maintenance/Service Logs

Keep track of the maintenance and service records for your vehicles.

An active subscription is required to use the application.

*The subscription will have options between 1-month (AUD$0.99) and 1-year (AUD$11.49) durations, with 1-month subscription providing a 1-week trial period (one time use only).

Payment will be charged to iTunes Account at confirmation of purchase. Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period. Account will be charged for renewal within 24-hours prior to the end of the current period, and identify the cost of the renewal. Subscriptions may be managed by the user and auto-renewal may be turned off by going to the users Account Settings after purchase. No cancellation of the current subscription is allowed during active subscription period.

Privacy Policy - http://travellogsapp.com/privacy.html

Terms of Use - http://travellogsapp.com/terms.html

SUPPORT

[email protected]